Tax & budget

Together we can make sure tax and budget decisions reflect our shared priorities and balance competing values.

Featured Resources

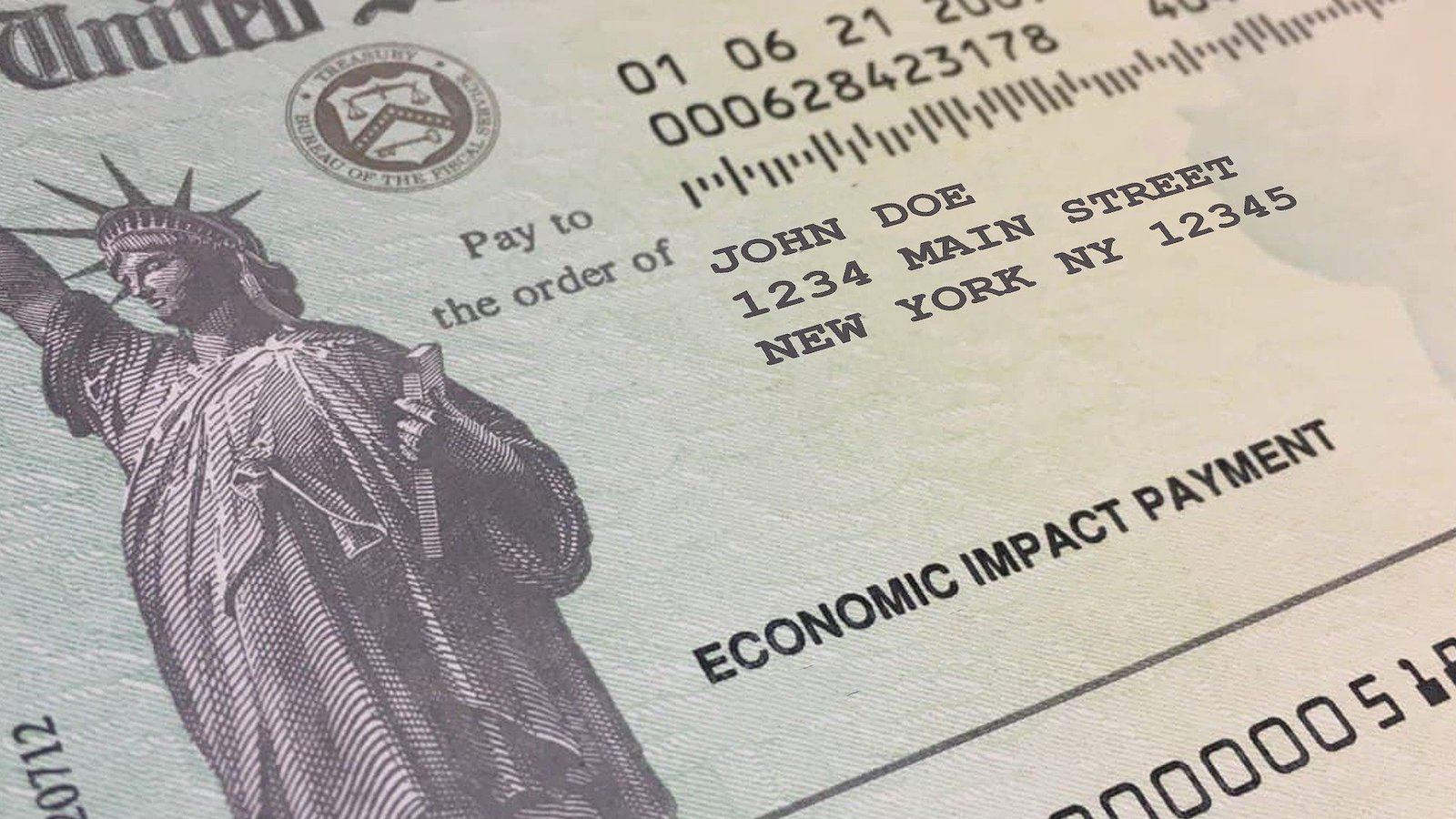

How to get your stimulus payments when you file your tax return

Fraudulent unemployment claims: You could be next — here’s what to do

Stimulus payments: Watch out for scams, and learn how to get your money if you didn’t get a check in 2020

The Latest

New Report: New Jersey Receives a “C+” in Annual Report on Transparency of Government Spending

New Jersey received a C+ when it comes to government spending transparency, according to “Following the Money 2014: How the 50 States Rate in Providing Online Access to Government Spending Data,” the fifth annual report of its kind by the New Jersey Public Interest Research Group Law & Policy Center (NJPIRG LPC).

Offshore Tax Dodging Saps $2.8 Billion from New Jersey’s Budget

NJPIRG, New Jersey Citizen Action, and the New Jersey Main Street Alliance came together at a Jersey City small business on 2/6/2013 to discuss a new NJPIRG study revealing that New Jersey lost $2.8 billion in state revenue due to offshore tax dodging in 2012.

New Report: New Jersey Receives a “C+” in Annual Report on Transparency of Government Spending

NJ receives a C+ in online access to government spending, in this third annual report.

New Jersey Earns “C+” in Annual Report on Transparency of Government Spending

New Jersey got a “C+” when it comes to openness about government spending, according to Following the Money 2011: How the States Rank on Providing Online Access to Government Spending Data, the second annual report of its kind by the New Jersey Public Interest Research Group (NJPIRG). Included with the report is aninteractive online tool that allows users to view what New Jersey is doing best and worst compared to other states’ transparency practices.